TODAY'S Budget is positive for Swindon, say chartered accountants Banks BHG.

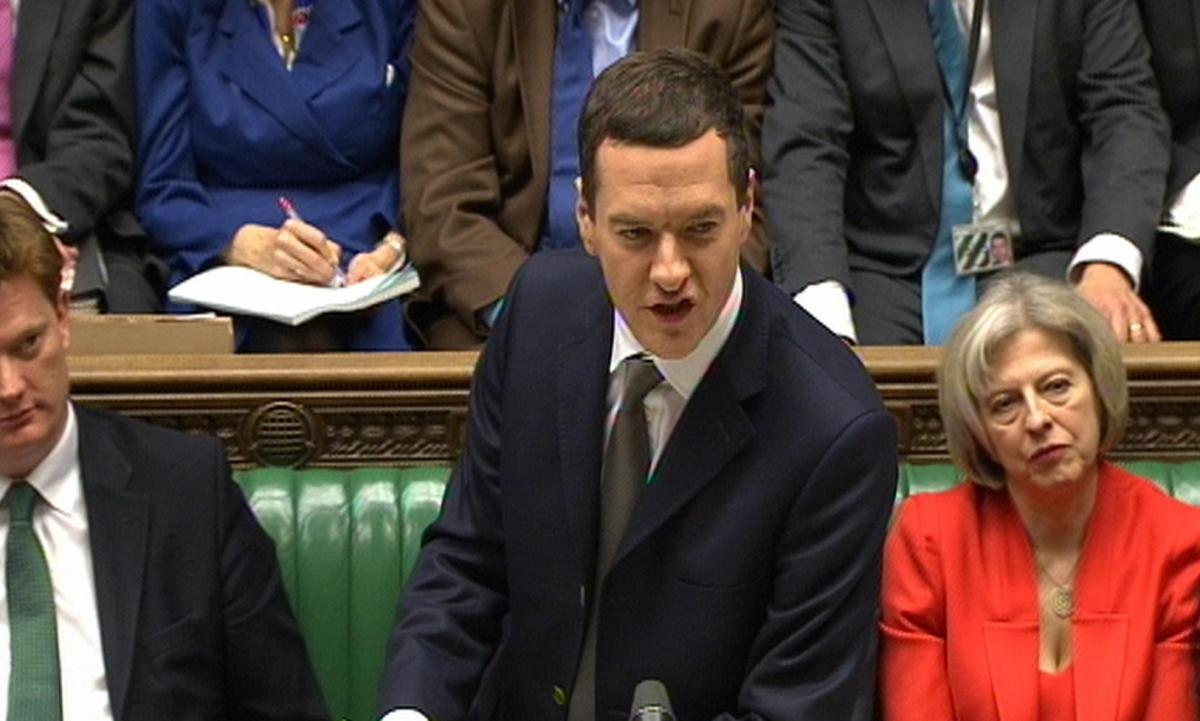

Chancellor George Osborne’s last budget before the general election on May 7 at first sight looks like good news for Swindon businesses and residents, says Banks BHG chartered accountants.

Banks BHG director Richard Mathews said: “At face value, it looks to be a positive Budget, which is to be expected given the improvements in the economy over the last 12 months.”

Included in the measures is the scrapping of Class 2 National Insurance for the self-employed. Businesses employing youth apprentices will now no longer pay National Insurance; an announcement to scrap NI for under 21s had previously been made.

“These measures appear to be good news for businesses, as does the planned review of the business rates system," he said.

"But we would like to have seen the Chancellor announce what the Annual Investment Allowance will be beyond December. Currently, it is £250,000 but it could drop back.

"And we would like more detail about the changes to Entrepreneur Relief, and to the Film and Tax credit scheme.”

Mr Mathews said for individuals, the new personal savings allowance - tax being waived on the first £1,000 of interest on savings - was good news, as were the increases in the personal allowance and the threshold for higher rate tax.

He said: “We also like the sound of the Help to Buy ISA for first-time buyers, but need a lot more detail on this.”

And Phil Smith, managing director of leaders' organisation Business West, said: “This was a budget focused on the big fiscal fundamentals, with George Osborne stressing his credentials on debt and deficit reduction in the lead in to the general election.

"We didn’t see big spending giveaways, which is a relief for those who know that tax pledges before elections are usually reversed immediately afterwards.

“Businesses will welcome many of the measures on business tax. Confirmation of the cut in the rate of corporation tax to 20% was aimed at sending a message globally that Britain remains open for business.

"It is the measures on National Insurance contributions and business rate reform that will be more of interest to small and medium firms though.

“Business rates reform was trailed in the Autumn Statement, and plugged again today. We await the detail with keen interest, but as reform has to be fiscally neutral, it is hard to see how we are going to see really fundamental reform of this outdated and unfair tax, without ‘robbing Peter to pay Paul’.

“There is better news for the self-employed, with the abolishment of class II National Insurance contributions.

"The abolishment of the annual tax return will be good news for all those small traders and the self-employed who have ever struggled with time consuming returns on the 31st of January – but it is unclear just how simple the alternative will be.

"The cancellation of fuel duty rise pencilled in for September will also reduce pressures on many firms’ bottom lines.

“The South West got some honourable mentions, with a £7 billion transport announcement and a 2% cut in cider duty.

“But what was most striking is how little attention is being paid to the West of England compared to the North of England. The Northern Powerhouse, a “comprehensive transport strategy for the North”, Manchester and new deals for West Yorkshire were all heavily underlined – as was the hopes for a stronger Northern economic performance in the future. Manchester being able to retain 100% of business rate growth was a real eye catching pledge.

“There is a real danger that our region is going to miss the boat if it fails to get its act together and put forward a clear offer to government on how we can grow our economy in return for delivering strong leadership for jobs, skills, transport and housing growth.

"Our local leaders must take note that others are stealing a march on us.”

Matthew Sewell, tax partner at Baker Tilly in Bristol, said: "This was an impressive display of political theatre by the Chancellor, but we may have to wait until the ‘real’ Budget after the general election to see if the new policy announcements made today will remain on the agenda, and what else we can expect to see in the next Parliamentary term.

"For businesses, this Budget provided some degree of reassurance with no further change to corporation tax, small technical changes to VAT rules and an announcement about a review of business rates. There will also be some relief among business owners that the allowances for Entrepreneurs Relief remain untouched, although there has been some tightening of the rules on eligibility.

"For private individuals, the Chancellor announced further increases in the personal allowance, taking more people out of the income tax system, but whether this will actually make lower earners significantly better off is a moot point, as many will suffer a reduction in tax credits as a result.

"One of the headline announcements was the proclaimed abolition of the tax return but this evident good news hides the reality that taxpayers will still have to confirm their income online and add details of income that HMRC doesn’t know about, such as business or investment income.

"Related to this, the announcement that from April next year the first £1,000 of the interest earned on savings will be completely tax-free for basic taxpayers will be welcomed by many, while higher rate taxpayers will benefit from a £500 allowance.

"This initiative should, in theory, help to make the new tax reporting system simpler, but we have some concerns given that HMRC doesn’t have an unblemished record when it comes to introducing new online services.

"The introduction of new Help to Buy ISAs will provide first time buyers with a generous perk, but it will be interesting to see what impact this has on the housing market without a significant increase in supply.

"This new policy, combined with the imminent pensions liberation changes and the revised stamp duty system could help to provide upward pressure on house prices at a time when they have started to cool.

"Many people had predicted that the Government would increase the thresholds at which Inheritance Tax is paid, but instead what we got was a review on the avoidance of inheritance tax particularly through the use of deeds of variation.

"This could be a means of preparing the ground for introducing a rise in the IHT threshold at a later date.

"Although there were no new specific measures mentioned in relation to tax avoidance, the Chancellor continued to highlight the Government’s determination to reduce options for aggressive tax planning and we wait to see what effect the numerous new measures already introduced will have in practice as we start to see them work."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel