Up to 500 small businesses in Swindon could get a boost this year.

The business rates that small retail businesses - shops, pubs cafes and restaurants - pay, the equivalent of their council tax - will be cut by a third this year.

Members of Swindon Borough Council’s scrutiny committee were all in favour, as they quizzed Coun Russell Holland, the council’s cabinet member for finance.

Coun Emma Faramarzi said: “I think this is a really positive move. It doesn’t seem to have been very well publicised. I think we should be shouting about it a bit louder

“I think it will be a lot of help to small businesses, and it’s the retail sector that really needs help. I hope it will help smaller independent businesses and shops and cafes and maybe even encourage people thinking about starting up to go ahead.”

Roger Shakles, the owner of sewing good and draper’s shop Sewcraft in Havelock Street also thought it would be helpful: “It will definitely be good for businesses like us in the town centre.

“We have issues like parking that cause us difficulties, whereas businesses in out-of-town shopping centres don’t have those sort of problems, so it will make a difference.

“We also need help in competing against online businesses. We have to pay rent and business rates because we have shops in town centres and have to put prices up to cover rises, but if you’re running a business from a garage, or from a unit somewhere where it’s much cheaper, you don’t have those costs.

“One idea I’ve heard to even it up a bit is to put a tax on packaging to help support retail businesses.”

But Mr Shakles was less certain the business rate cut would encourage would-be shopkeepers to take the plunge and start their own business: “In my line there are shops going all the time, and in the past there was always someone ready to have a go and take their place but that’s not happening now.

“But the cut will definitely help small businesses in the town centre.”

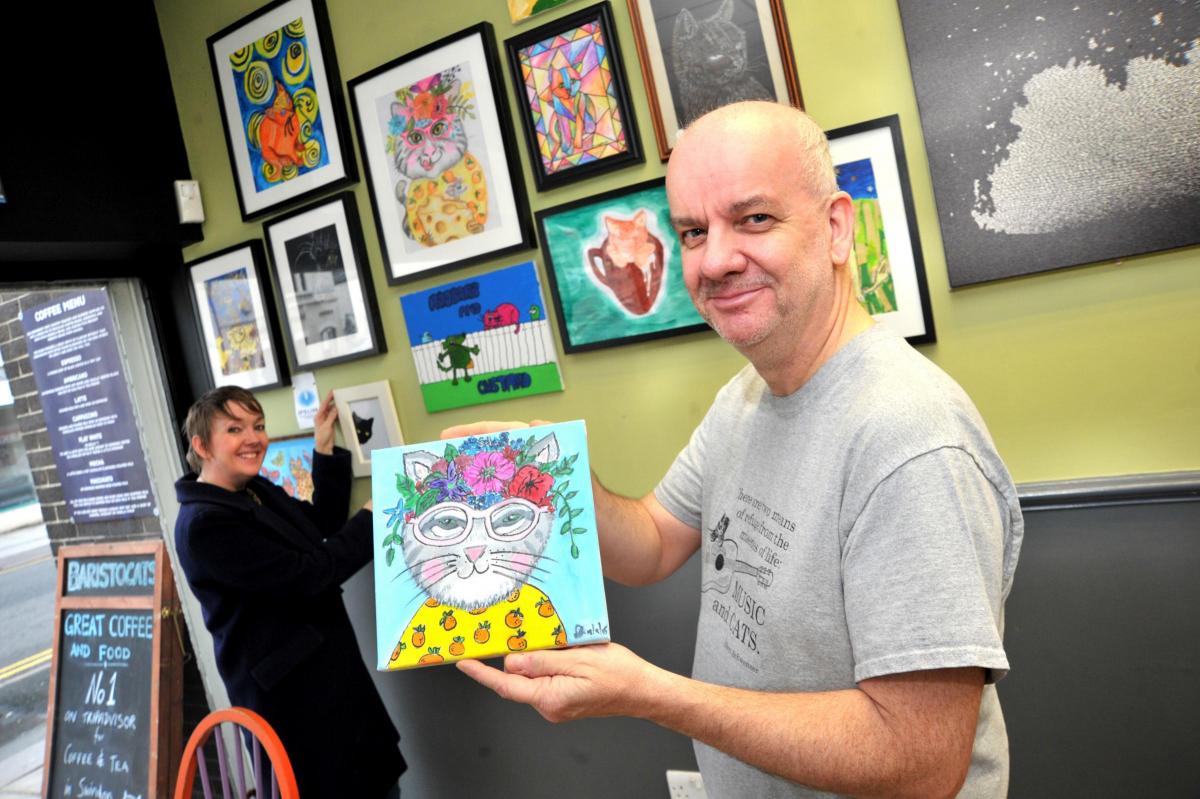

Owner of Baristocats coffee bar in Commercial Street, Marcus Kittridge said he was glad of the relief, but still believed business rates were set too high.

He said: “It’s done by central government valuers, not by the council - they just send the bills out. We’re in one of the ugliest buildings in the town centre and it’s been sold twice in recent years and I know the value of it has gone down from £1.6m to £1m - that’s a 40 per cent drop. But that’s not reflected in the valuation made of it for calculating business rates.

Retail businesses in a building with a rateable value of less than £51,000 will be eligible for a third off their business rates in the next two financial years.

Bills will be sent out in early April - if any business thinks it is eligible for the rate relief but hasn’t had it should contact the council’s business rates team on 0845 602 0146

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here